When you start to accept applications for your rental property, you’ll inevitably get some applications that do not meet your minimum screening standards (even if you list them in the listing, some people just don’t read or don’t care).

When this happens, you’ll have to carefully review the application and send back a Tenant Application Decline Letter and an Adverse Action Notice. So, what should be included in this letter?

Tenant Application Rejection/Adverse Action Notice Letters should include the reasons the application was declined, the reporting agency’s contact information from which you got the credit/background report, a statement explaining that the reporting agency did not make the final decision, and your contact information in case they have follow up questions.

With those main points in mind, I’ll cover everything you need to understand how to legally decline a tenant application and handle appeals below.

Let’s dive in!

Quick Navigation

- Reasons For Denying A Tenant Application For Your Rental Property

- How To Prepare For A Tenant Application Rejection

- How To Write A Tenant Application Decline Letter With Adverse Action Notice

- How To Handle Tenant Inquiries and Appeals To Adverse Action Notice Letters

- Final Thoughts

- Related Content

1. Reasons For Denying A Tenant Application For Your Rental Property

First, we must discuss the reasons you have for denying the application for your rental property. The reasons must comply with Fair Housing Laws and should not be discriminatory based on race, color, national origin, religion, sex, familial status, or disability.

The best way to make sure you are always being unbiased and following fair housing laws is to make the application decision process as quantifiable as possible and to only include factors that would truly help you determine whether they will pay rent on time and take care of the property.

The common factors that can lead to a tenant application rejection include:

- Incomplete, inaccurate, falsified, or unverifiable information on the application

- Unpaid application/screening fee

- The rental was already committed to another individual(s) at the time the application was received

- The rental was given to an individual(s) who was more qualified based on our screening standards

- Inadequate income based on our minimum screening standards

- Poor credit history or low credit score based on our minimum screening standards

- Negative rental history/past evictions based on our minimum screening standards

- Insufficient references based on our minimum screening standards

- The other minimum screening standards of smoking, pets, occupancy, use, etc were not met

- Approval was conditional, but the conditions for deposit, rent, co-signer, or other conditions were not met

- The unit could not be held until the desired move-in date or until the move-in requirements could be met

Any of these reasons are acceptable reasons to decline a tenant application and fall within the guidelines of the fair housing laws.

In our experience, most of the applications we’ve declined have been based on the individual not meeting one or more of our minimum screening standards or because the rental was already committed to another individual at the time the application was received.

2. How To Prepare For A Tenant Application Rejection

As you receive applications, you want to review them immediately and thoroughly. We try our best to review the applications on a first-come, first-served order to make the screening process as fair as possible.

As soon as we get an application that meets our minimum screening standards, we schedule a showing and typically accept their application. However, there have been a few times when we’ve gotten two qualified applicants around the same time.

In those rare situations, we show the home to both and offer the home to the most qualified applicant first. If they want the home, then it is theirs. Otherwise, we offer the home to the second most qualified applicant.

The faster you can review an application and approve or decline it, the more likely any qualified applicants will choose to rent your property over another and the faster a denied applicant can move on and find another place to rent.

The Screening Criteria Must Be Consistent For All Applicants

In addition, being consistent with your minimum screening requirements is crucial to avoid breaking any fair housing laws. Decide what you want to screen your property on before listing it, then stick to those requirements throughout the entire process.

For us, we like to screen on the following requirements:

- No evictions on record

- No violent criminal history/felonies on record within the last 8 years

- Minimum credit score of 600 with no collections and no delinquent open loans on record (or a cosigner/guarantor might be required – as long as one person passes the minimum credit requirement, they can count as a cosigner for everyone else in the household if needed)

- The monthly household income must be 3x the rent price (plus pet fee if applicable) or greater

- The home is also non-smoking

- No more than 2 occupants are permitted per bedroom

- Pets are an extra $50 a month added to the rent and must be covered on your renter’s insurance (max: 2 pets)

As we receive applications, we make a scorecard based on the first 4 items from the list above (income, eviction history, credit score/credit history, felony record). If the applicant received a 4/4 (meaning they have a monthly household income that is 3x the rent, no evictions, no felonies with the last 8 years, and a 600 credit score or greater with no collections and no delinquent open loans) then they pass our minimum screening standards. If they get any less than a 4/4, then we decline their application and send them an Adverse Action Notice/Tenant Application Decline Letter (explained below).

We also make a file for the denied applicant in our Google Drive where we add their application, background report, credit report, scorecard, and Adverse Action Notice/Application Decline Letter with the reason why they were declined. Keeping these records is important so no denied applicant can come back months later and try to sue you for discrimination.

3. How To Write A Tenant Application Decline Letter With Adverse Action Notice

When you reach back out to an applicant who has a rejected application, you want to send them an Application Decline Letter (most likely with an Adverse Action Notice attached).

An Adverse Action Notice is a letter that states why an applicant was denied a rental agreement, credit, employment, insurance, or other benefits based on information found in their credit report. It also includes the reporting agency that supplied the report, their name, address, and phone number, and how the applicant can contact them to dispute any inaccurate information found on their report.

The Fair Credit Reporting Act requires that landlords/property managers supply an Adverse Action Notice if the application was denied in whole or in part based on anything found within their credit and background report.

No matter the reason why we are declining the application (but especially if we are declining it based on not meeting our minimum screening standards), we always include the Adverse Action Notice at the end of the letter so we are covered legally.

Sending an Adverse Action Notice/Application Decline Letter also looks more professional on our part and gives the applicant the chance to learn what they need to improve to be approved for a rental based on our criteria in the future.

Now, let’s discuss what should be included in a one-page tenant rejection letter and go over some examples.

A. Reason(s) Application Was Declined

To begin the letter, you want to include the date, the name of the applicant, and a brief thank you for submitting an application. After that, the list of possible reasons for the denial (from what we discussed above) should be included along with checks next to the items that are true for why this application was declined.

Application Rejection Reason Examples:

Example:

Dear Amanda, Date: 10/6/2023

We appreciate your recent application to rent one of our homes. Unfortunately, we must inform you that your application has not been approved due to the following reason(s):

- [ ] The application was incomplete, inaccurate, falsified, or contained unverifiable information

- [ ] The required application fee was not paid

- [ ] The rental was committed to another individual(s) at the time of application receipt

- [ ] The rental was given to a more qualified applicant according to our screening standards

- [ * ] Our minimum screening standards for income, credit score or credit history, past evictions, background history, or references were not met

- [ ]Our other minimum screening standards for smoking, pets, occupancy, use, or other were not met

- [ ] The application was conditionally approved, but the deposit, rent, co-signer, or other specified conditions were not met

- [ ] We could not hold the unit until the desired move-in date or until meeting move-in requirements

- [ ] Other: __________________________________________

B. Reporting Agency Name, Address, and Phone Number

Next, you want to include the Adverse Action Notice portion of the letter.

Include the explanation that the application was denied in whole or in part based on the information found in the Consumer Report received from the following Consumer Reporting agency.

Then list the reporting agency’s name, address, and phone number, so they can contact them if necessary.

As of the writing of this article, Zillow uses Experian to supply the Consumer Report for applications from their portal and Apartments.com uses TransUnion to supply the Consumer Report for applications from their portal.

Application Rejection Reporting Agency Examples:

Example:

The application was denied in whole or in part based on the information found in the Consumer Report received from the following Consumer Reporting agency:

Reporting Agency: Experian

Address: Experian’s address

Phone: Experian’s phone number

C. Statement That The Reporting Agency Did Not Make The Final Rental Decision

Next, it’s required to let the applicant know that the reporting agency listed above did not make the final decision and cannot give them any information regarding their denial. However, they legally can request a free copy of their credit report from the agency within 60 days of receiving this Adverse Action Notice or dispute the accuracy of the report from the Consumer Reporting Agency listed.

Including this statement lets the applicant know what next steps they can take to receive more information. If there is an error in their report, then they need to take it up with the reporting agency. Or if they want to know more specifics about what they were denied, they can contact you for more information.

Reporting Agency Disclaimer Statement Examples:

Example:

The Consumer Reporting Agency mentioned earlier was not responsible for the decision to decline your application and is unable to furnish any details regarding the denial. You have the legal entitlement to request a complimentary copy of the report within 60 days from the date of receiving this notice from the aforementioned Consumer Reporting Agency or to contest the accuracy of the report with them. We apologize for any inconvenience, but we are unable to supply additional information at this time.

D. Landlord/Property Manager Name, Address, and Phone Number/Email

Finally, provide your contact information so they can reach out if they have any further questions or want to appeal the denial.

Application Rejection Reporting Agency Examples:

Example:

The application was denied in whole or in part based on the information found in the Consumer Report received from the following Consumer Reporting agency:

Manager: Your name

Address: Your mailing address

Phone/Email: Your phone number or email address (whichever way you prefer them to contact you)

After this letter is written, we email the letter to the denied applicant. 99% of the time, we don’t get a response back (because they knew they weren’t going to pass, but wanted to try anyway).

However, occasionally, we will get a response back asking for more information on what specifically they were denied. That’s where the next section comes into play.

8. How To Handle Tenant Inquiries and Appeals To Adverse Action Notice Letters

Occasionally, a denied applicant will reach out asking what specific requirement they didn’t pass. Most of the time, it’s a credit score/credit history requirement that they didn’t pass on. And most of the time, these tenants recently checked their Credit Karma report to see if their credit score would meet the minimum requirement.

Unfortunately, Credit Karma is notorious for showing a higher credit score than the actual credit reporting agencies and for missing information that is on their real report. When that happens, the applicants are confused and want the application to be reconsidered.

When this happens, we explain that the report we received did not meet our minimum screening requirements and that they can request a copy from the reporting agency listed in the letter to see what was on their report that failed our minimum requirements.

It is important to stay consistent with your rejection decision so that all applicants are treated fairly. If the application was denied based on income, felony records, or eviction records, then there is nothing we can do to change the decision.

However, there are times when we can be a little bit flexible with a denied applicant who does not meet the credit history/credit score requirement. If the applicant can find a co-signer, then we can pass the application conditionally based on the co-signer agreeing to sign the lease with them.

Or if the credit score meets the 600 minimum, but there is a small collection on their account, then in the past, we’ve requested that the applicant get a letter from the collection agency stating that the balance is an error on their report or that they paid the balance in full. (This typically only works when the collection account is under $100.)

We’ve had a tenant take the time to get the $69 collection (that they didn’t know about) paid and removed from their record, so we were able to pass them on this requirement and approve their application. This is a random and rare situation, but I wanted to include it because we were able to work out a way for the tenant to pass the qualifications because she was willing to work with us and communicate with us. (And she’s been a fantastic tenant ever since!)

Final Thoughts

That’s it! By now, you have a fully written Adverse Action Notice/Tenant Application Decline Letter. Now, all that’s left to do is get ready for the lease signing!

You’ll also be able to prepare a New Tenant Orientation Letter so you can easily train the new tenant on your rules and regulations while you are at the lease signing.

We’ve found that by sticking to our minimum screening standards and sending out Adverse Action Notice Letters, we are seen as professionals and protect ourselves legally against any issues that might come during the tenant screening process. This ultimately helps us find better tenants for our rental property who pay on time and take care of the property.

I hope you find this article useful and that it helps attract tenants who would love to live in your rental home!

Catch you in my next post!

Related Content

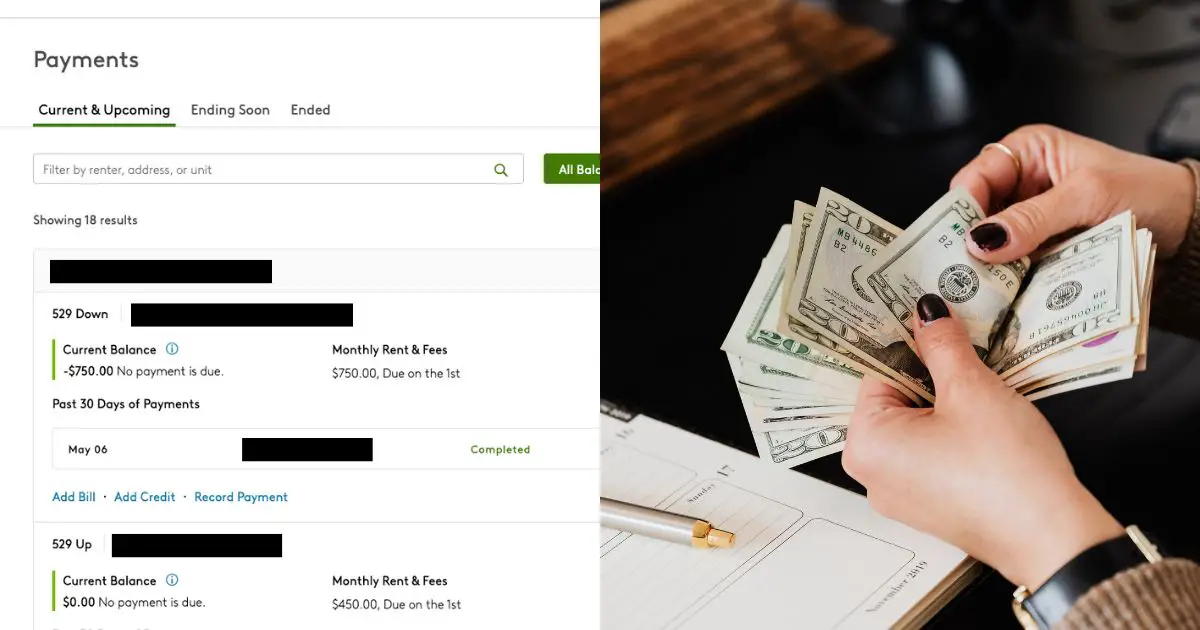

Check out my recommended tools, templates, and resources to free up your time from constantly working on and worrying about your rental properties. My husband and I use these tools to self-manage 18 rental units (and counting) for only 5-10 hours a month.

Keep in mind that most of these items are either free or reasonably priced for the amount of value that they provide. My goal on this page is to recommend tools, templates, and resources that we use daily and wish we had known about at the beginning of our landlord journey. Since implementing them, they’ve saved us countless hours and tons of headaches.

Finding good tenants for a rental property is arguably one of the most essential tasks that a self-managing landlord must accomplish. You’re searching for a high-quality tenant that will pay on time, take care of the property, and be easy to communicate with all while trying to get the most amount of rent and filling the vacant unit as quickly as possible.

That’s no small feat! So, how can you find good tenants for your rental property?

By Christine

Christine is a blogger and real estate investor/property manager who self-manages 18 rental units (and counting) alongside her husband, Adam. Although she successfully automates the management of her rentals and pockets the property management fee now, her path to success was not easy.

Go here to read her story, “From An Overwhelmed First-Time Landlord To A Pro Investor Self-Managing 18 Rentals On Less Than 10 Hours Per Month“.

Recent Posts

How To Reject A Tenant Application (With Examples!)

When you start to accept applications for your rental property, you’ll inevitably get some applications that do not meet your minimum screening standards (even if you list them in the listing, some people just don’t read or don’t care). When this happens, you’ll have to carefully review the application and send back a Tenant Application…

How To Write A New Tenant Welcome Letter For Your Rental Property

When we have found a new tenant that we are ready to sign a lease with, we want to start the new relationship off on the best terms possible. In order to do that, we need to ensure that they are familiar with the most important details of the lease. We do this by providing…

Ultimate Guide To Collecting Rent And Charging Late Fees As A Landlord (Easy System!)

Collecting rent from tenants is one of the most time-consuming (and emotionally charged) parts of being a landlord. Not only will you get every excuse under the sun about why rent will be late this month (again), but you will also miss out on opportunities to collect extra income and increase rent over time if…