Verifying a potential tenant’s income is an important part of the tenant screening process.

Oftentimes, applicants stretch the truth on how much income they make or try to get housing that takes up too much of their monthly income. When that happens, it can significantly increase the chances of delinquent rent payments.

Rental property applicants should have a household income that meets or exceeds three times the rent amount. Verifying that the rent price is 33% or less of a tenant’s monthly household income helps increase the chance that the tenant will be capable of paying their rent each month.

With those main points in mind, I’ll cover everything you need to verify an applicant’s income and employment so you can find a tenant who is more likely to pay on time below.

Let’s dive in!

Quick Navigation

- Why Landlords Should Verify Applicant Income & Employment

- Who’s Income Should Be Verified On An Application

- Types Of Income To Verify

- How To Verify Traditional Income (Employment Income & Government Assistance Income)

- Questions To Ask When Verifying Income & Employment For A Rental Property

- How To Verify Non-Traditional Income (Self-Employed Income & Investment Income)

- Be Mindful Of Fair Housing Laws While Verifying Applicant Income & Employment

- How To Calculate An Applicant’s Income-To-Rent Ratio

- What To Do If The Applicant Does Not Pass The Income Requirements

- What To Do If The Applicant Does Pass The Income Requirements

- Final Thoughts

- Related Content

1. Why Landlords Should Verify Applicant Income & Employment

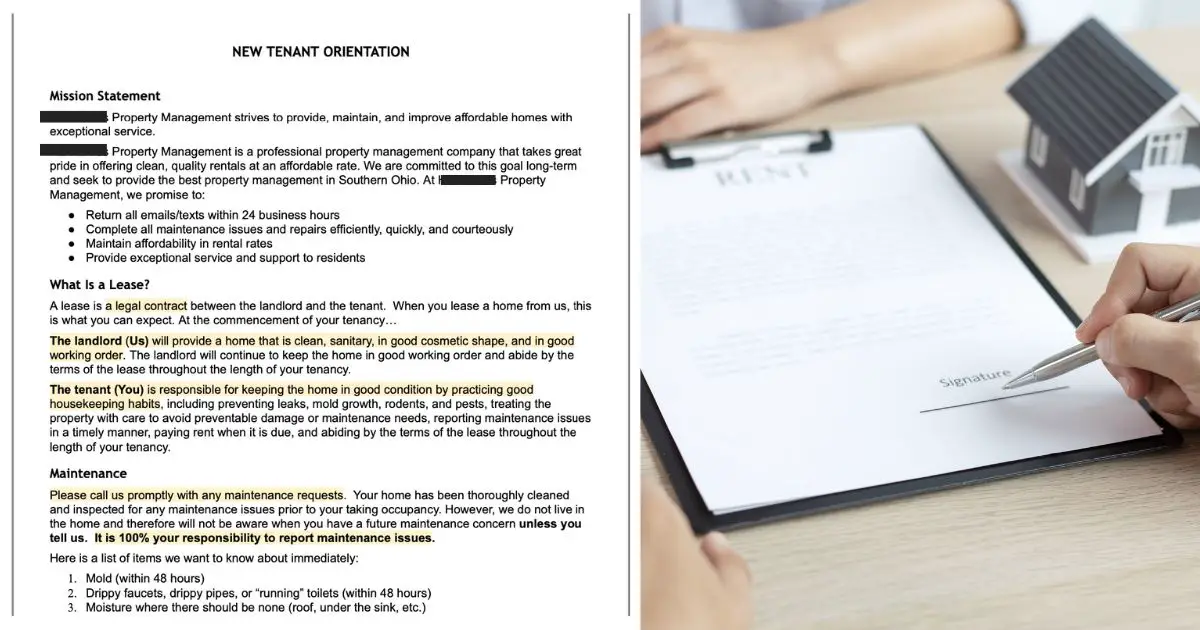

The two biggest problems when dealing with tenants are rent collection and maintenance requests. During the tenant screening process, it is our goal as self-managing landlords to try and find the tenants that will make both of these problems non-existent.

One way to make the rent collection process easier is to verify a potential tenant’s household income and employment.

By verifying a tenant’s income, we can attempt to assess a tenant’s financial stability and ability to pay rent on time. If their income is high enough compared to their rent price, then we can minimize the risk of potential late rent payments or evictions.

Of course, a tenant’s employment situation can (and likely will) change over time, so verifying income and employment is not a foolproof way to ensure the rent payments will come on time. But it is one of the first areas we want to check to see if they have a history of keeping a job that pays them enough money to cover their bills.

2. Who’s Income Should Be Verified On An Application

When reviewing applications for your rental property, you want to look at the household income of all applicants over 18 years old. This household income should be 3 times the rent price or greater, and all income sources should come from verifiable sources (discussed below).

Why review the household income instead of an individual? Since everyone in the household over 18 years old will be responsible for the rent, we don’t care how they break up who pays the rent. All we care about is that the total household can “afford” the rent price.

Why 3 times the rent price instead of 2 times, 1 time, or any other ratio? This is because keeping the rent price at 33% or lower of a tenant’s monthly household income will hopefully help give them enough wiggle room to afford their rent payment and other bills. Ideally, everyone’s housing expenses would be 25% or less of their take-home pay, but that is difficult for most people to achieve, so 33% or less of their take-home pay is a great compromise.

No this does not guarantee the applicants can afford all of their bills because many people do live paycheck to paycheck (or live with a ton of debt), but it will increase the likelihood that they will be able to afford all of their bills since their housing will only be 1/3rd of their total take-home pay.

Of course, you can’t control how tenants spend their money, but you can only allow tenants to rent from you that has the potential to have enough room in their budget to afford their rent payment and other financial obligations.

If the tenant’s rent payment makes up 50% of their income (income only being 2 times the rent) then you are already setting them up for failure because they will have a hard time affording rent and their daily life expenses.

3. Types Of Income To Verify

Now that we know whose income we should review, let’s discuss what types of income are considered verifiable.

The different types of income you can verify include:

- Employment income (Pay stubs, W2 tax filings, etc)

- Self-employment earnings (1099 tax filings, bank account statements showing income payments, etc)

- Government assistance (Social Security payments, disability payments, Section 8 payments, etc.)

- Investment income (rental income, stock market income, etc.)

The easiest incomes to verify are employment income and government assistance income because they come from outside entities (their employer or the government) that you can call or email and verify the stability of their payments.

Self-employment earnings and investment income are a little more difficult to verify, but not impossible (more on that below).

4. How To Verify Traditional Income (Employment Income & Government Assistance Income)

The best way to verify traditional income is to call each applicant’s employer or government assistance caseworker to verify their income (instead of/on top of asking for pay stubs, tax returns, or bank statements).

Many applicants will submit their pay stubs to you at the time of applying as well. These are nice to review, but they can easily be forged, so we just glance at them without giving them too much weight.

Many of the forged ones have incorrect information on them (such as dates not lining up or amounts not adding up correctly), so you might be able to catch some obvious fake ones. If you find a fake one, that is grounds for automatic disqualification. If they are willing to start the relationship with you on a lie, then they are going to continue to lie/make poor decisions while renting from you.

From the pay stubs I’ve seen, it is often difficult to tell which ones are fake or real. So, instead, we ask for the employer’s name, then we Google the employer separately to get their phone number and give them a call to ask a few questions.

It’s crucial to Google the company or government assistance agency for their phone number instead of using the phone number that the applicant supplies because they could be giving you a buddy’s number that is pretending to be their employer. (Yes, some people are too smart for their own good haha.)

If you find an email address for the employer, then you can email them instead of calling (which is nicer because then there’s a paper trail of the conversation).

5. Questions To Ask When Verifying Income & Employment For A Rental Property

When talking to (or emailing) an applicant’s employer, we like to ask a few basic questions. Then we let the employer or government assistance agent do the rest of the talking.

We always lead by introducing ourselves as the property managers and explaining the intent of our call, which is to verify employment and income for an applicant wanting to rent one of our properties.

Some of the questions we ask employers to verify income and employment for a rental property are:

- Applicant’s position

- Applicant’s hourly wage

- Applicant’s average hours worked each week

- Applicant’s date of hire

- Is the Applicant considered temporary? (yes or no)

- Additional comments from the employer

- Name and title of the person at the company you are talking to

For applicants using government assistance, the questions that we ask are similar but slightly different. Some of the questions we ask government agency caseworkers to verify income for a rental property are:

- Applicant’s monthly payment received from the program

- Applicant’s length of time with the program

- Is the Applicant in good standing with the program? (yes or no)

- Additional comments from the caseworker

- Name and title of the person at the agency you are talking to

For some government programs (such as Section 8), we don’t even have to call the program. The applicant will have a packet that clearly states how much of the rent they have covered by the program. Just have them send you a picture of their voucher/packet that shows this amount to verify their income from Section 8.

Our goal is to make sure the company or government agency has this applicant in their records, that they can confirm the amount of income they’ve stated on their application is accurate, and that the applicant is financially stable.

If the employer/caseworker gives us any other information (such as they are frequently late/skip work or have had issues staying in the program in the past), then that’s icing on the cake in helping us make our decision. But we are mostly going for income verification because that’s a quantifiable value we can compare against other applicants.

6. How To Verify Non-Traditional Income (Self-Employed Income & Investment Income)

Verifying self-employment and investment income can be a little bit more tricky, but not a deal breaker.

Some of the items we like to review to verify self-employment income for a rental property are:

- The previous year’s tax returns

- Any recent payment receipts they’ve received/bank statements showing these payments

Since there isn’t an employer to contact, there’s not much more we can check to verify consistent income (also because they likely don’t have consistent income from month to month). And since we have other screening requirements that help us determine their financial stability, we mostly look for any proof we can find that they are likely averaging at least 3x the rent amount each month and that they have gotten payments recently from their work.

Some of the items we like to review to verify investment income for a rental property are:

- The previous year’s tax returns

- Any recent payment receipts they’ve received/bank statements showing these payments from rental properties or investment companies

The previous year’s tax returns are helpful to get a big picture of the income they likely are bringing in, while the last 2 months’ bank statements with deposits showing in their account are helpful to verify they are still bringing money in.

Outside of that, checking the credit score of applicants with self-employed income or investment income will be crucial in determining their overall financial history and financial stability.

7. Be Mindful Of Fair Housing Laws While Verifying Applicant Income & Employment

As you are verifying applicants’ income and employment, be mindful of the Fair Housing Laws.

We don’t want to discriminate based on race, religion, sex, color, national origin, familial status, or disability. Our only goal is to find the best applicant who will pay rent on time and take care of the property.

To be in compliance with Fair Housing Laws, be sure to keep your screening standards as quantifiable as possible. Checking that the household income is at least 3x the rent is a quantifiable value that they either meet or they do not.

Then, if they do meet that minimum requirement, you can go one step further and compare their income-to-rent ratio to another applicant’s income-to-rent ratio when screening to choose the tenant with the better ratio because that is still a quantifiable number that has nothing to do with any of the discriminatory characteristics listed above.

For example, Applicant 1 has a household income-to-rent ratio of 3.1x (household income divided by rent price) while Applicant 2 has a household income-to-rent ratio of 4.3x. Depending on the other screening criteria, Applicant 2 might be the better tenant to choose because they bring in more income compared to their rent payment each month.

The better way to screen applications is on a first-come, first-served basis (if possible). Unless you hold an open house, you’re likely only getting in 1 application at a time. As each application comes in, review it right then and there.

If the application passes all of your minimum screening requirements, then you can schedule a showing with them and move forward with the lease signing process. And if they do not, then you reach out to let them and let them know what screening requirement they fell short on.

We’ve found that this helps us minimize problems because we are reviewing each application individually instead of comparing. They either pass the minimum requirements or they do not.

8. How To Calculate An Applicant’s Income-To-Rent Ratio

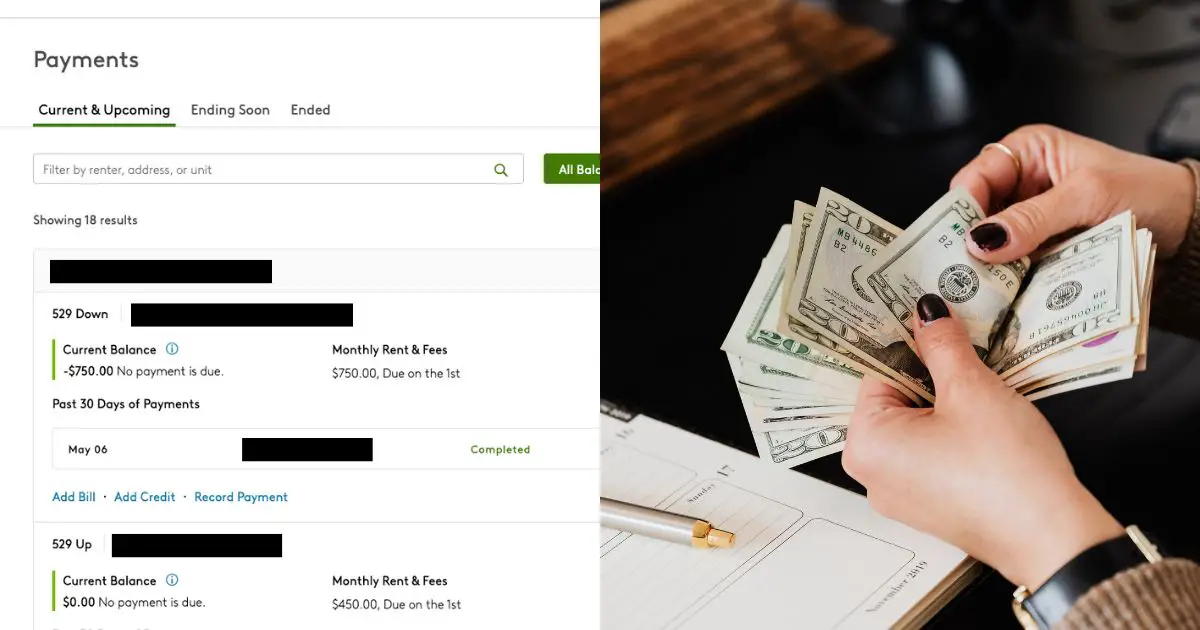

Previously I mentioned comparing two applicants’ household income-to-rent ratios. Most application collection software will calculate this number for you (Zillow and Apartments.com both display this number easily for you on each application).

But just in case you need to calculate this ratio manually, here’s how to calculate the income-to-rent ratio:

Income-To-Rent Ratio = Household Income / Rent Price

Again, we are looking for an income-to-rent ratio of 3 or higher. This number helps the tenant have some wiggle room after their rent payment to pay their other bills on time as well.

9. What To Do If The Applicant Does Not Pass The Income Requirements

Now that you’ve calculated the applicant’s household income-to-rent ratio (which probably took you all of 2 seconds), it’s time to decide if they meet this requirement or not.

If the ratio is less than 3, then the application fails (regardless of the other screening requirements) and a Tenant Application Decline/Adverse Action Notice Letter must be sent explaining what they failed on.

The only time we skip the income requirement on an application is if we are filling a home with a Section 8 tenant. If they have a voucher that will cover their full rent price, then we pass them on this requirement because they aren’t responsible for any portion of the rent (all of the rent will come from Section 8).

But if they have a partial voucher, then we require that their household income be 3x of the portion of their rent not covered by the Section 8 voucher. This helps make the comparison fairer to non-Section 8 applicants because we are still comparing their household income to the portion of the rent they are responsible for coming out of pocket (instead of the entire amount).

10. What To Do If The Applicant Does Pass The Income Requirements

If the applicant’s household income-to-rent ratio is greater than 3, then we check to see if they meet the other minimum screening requirements (credit check, background check, rental history check). If they do, then we schedule a showing with them, otherwise, we send them an Adverse Action Notice Letter explaining what they failed on.

Final Thoughts

That’s it! By now, you have a great idea of how to verify an applicant’s income and employment for a rental property. Now, all that’s left to do is review their credit history, background report, and rental history!

We’ve found that by verifying that an applicant’s household income exceeds 3x the rent price along with our other screening requirements, we get tenants that pay on time (and oftentimes in advance). This ultimately helps us run our rentals smoothly for only 5-10 hours a month.

I hope you find this article useful and that it helps you attract tenants who would love to live in your rental home!

Catch you in my next post!

Related Content

Check out my recommended tools, templates, and resources to free up your time from constantly working on and worrying about your rental properties. My husband and I use these tools to self-manage 18 rental units (and counting) for only 5-10 hours a month.

Keep in mind that most of these items are either free or reasonably priced for the amount of value that they provide. My goal on this page is to recommend tools, templates, and resources that we use daily and wish we had known about at the beginning of our landlord journey. Since implementing them, they’ve saved us countless hours and tons of headaches.

Finding good tenants for a rental property is arguably one of the most essential tasks that a self-managing landlord must accomplish. You’re searching for a high-quality tenant that will pay on time, take care of the property, and be easy to communicate with all while trying to get the most amount of rent and filling the vacant unit as quickly as possible.

That’s no small feat! So, how can you find good tenants for your rental property?

By Christine

Christine is a blogger and real estate investor/property manager who self-manages 18 rental units (and counting) alongside her husband, Adam. Although she successfully automates the management of her rentals and pockets the property management fee now, her path to success was not easy.

Go here to read her story, “From An Overwhelmed First-Time Landlord To A Pro Investor Self-Managing 18 Rentals On Less Than 10 Hours Per Month“.

Recent Posts

How To Reject A Tenant Application (With Examples!)

When you start to accept applications for your rental property, you’ll inevitably get some applications that do not meet your minimum screening standards (even if you list them in the listing, some people just don’t read or don’t care). When this happens, you’ll have to carefully review the application and send back a Tenant Application…

How To Write A New Tenant Welcome Letter For Your Rental Property

When we have found a new tenant that we are ready to sign a lease with, we want to start the new relationship off on the best terms possible. In order to do that, we need to ensure that they are familiar with the most important details of the lease. We do this by providing…

Ultimate Guide To Collecting Rent And Charging Late Fees As A Landlord (Easy System!)

Collecting rent from tenants is one of the most time-consuming (and emotionally charged) parts of being a landlord. Not only will you get every excuse under the sun about why rent will be late this month (again), but you will also miss out on opportunities to collect extra income and increase rent over time if…